START YOUR JOB SEARCH

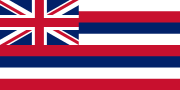

Dashboard > State Search > Hawaii

{{mapHeader}}

Capital

Honolulu

State Population

1,088,216

Veteran Population

87,357

Veteran Population Percentage

8.03%

Veteran Benefits

16

Choose your path.