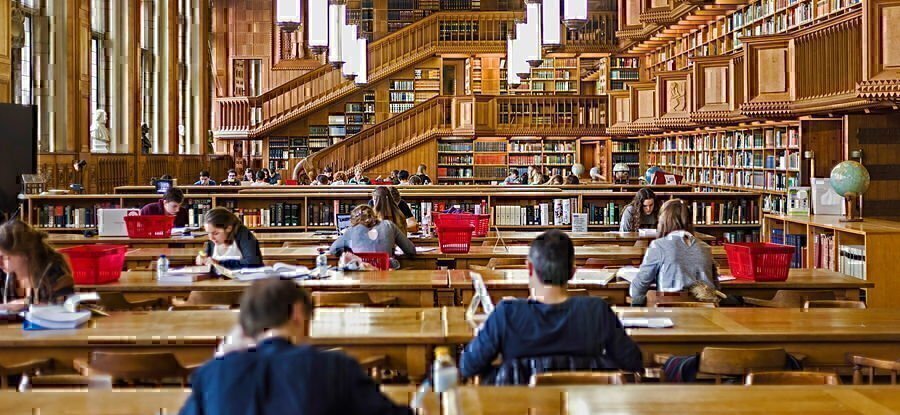

Elgin Community College offers a collaborative support environment with designated individuals in Academic Advising, Admissions, Financial Aid, Career Development Services, Tutoring, Disabilities Services and Student Life, who works with the Coordinator of Veteran Services to ensure success for student veterans. Our Veteran Resource Center serves as a central hub on campus for veterans and military spouses to study, relax, receive additional resources and network with other veterans. We are a chapter member of S.A.L.U.T.E. Veterans National Honor Society to recognize the hard work and academic excellence that our student veteran achieves while attending ECC.

© 2023 VIQTORY | Military Friendly® is owned and operated by VIQTORY, a service-disabled, veteran-